Electric utility vehicles (EUVs) are battery-powered industrial vehicles designed to move people and materials efficiently in workplaces. They include everything from electric forklifts and tow tractors to utility carts and burden carriers.

These vehicles produce zero tailpipe emissions, making them ideal for indoor use and aligning with corporate sustainability goals. In fact, as companies pursue greener operations, the electric utility vehicle market has been surging in growth. This rapid rise is driven by demand for cleaner, quieter equipment and advancements in battery technology.

Today industrial warehouse managers are increasingly encountering EUVs in their daily operations. By the end of this article, you’ll have a comprehensive understanding of why electric utility vehicles are on the rise and how they can benefit your operations.

Let’s dive in!

What Are Electric Utility Vehicles?

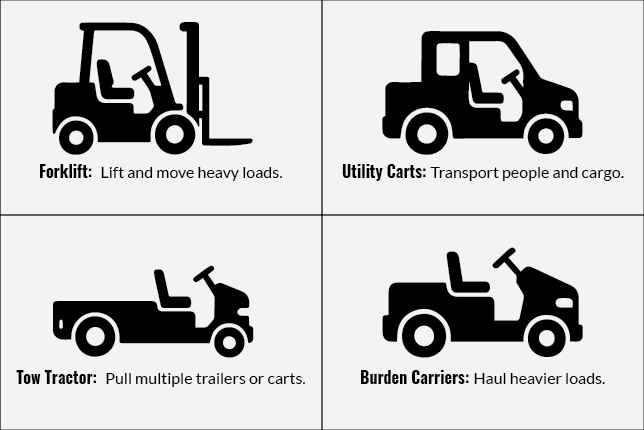

Electric utility vehicles (EUVs) are a broad category of electric industrial vehicles used for tasks such as material transport, towing, personnel movement, and maintenance in industrial and commercial settings. They are all battery-powered utility vehicles, typically using rechargeable batteries (either traditional lead-acid or modern lithium-ion packs) as their energy source instead of internal combustion engines.

Electric Industrial Vehicles vs. Electric Utility Vehicles: The terms can overlap, but generally electric industrial vehicles refer to equipment like forklifts and other heavy machinery used in production or warehouse environments, while electric utility vehicles often denote smaller, versatile vehicles used for a variety of support tasks.

Electric Light Utility Vehicles and Compact Utility Vehicles: A significant segment of EUVs are the lightweight or compact models. These include small electric carts and low-speed vehicles designed for environments where a full-size truck or forklift would be impractical. Compact utility vehicles (often resembling golf-cart-style or small pickup-style EVs) are used in facilities with narrow pathways or weight-sensitive floors.

Common Applications

Electric utility vehicles have become common in a range of applications across industries. Some of the most common use cases include:

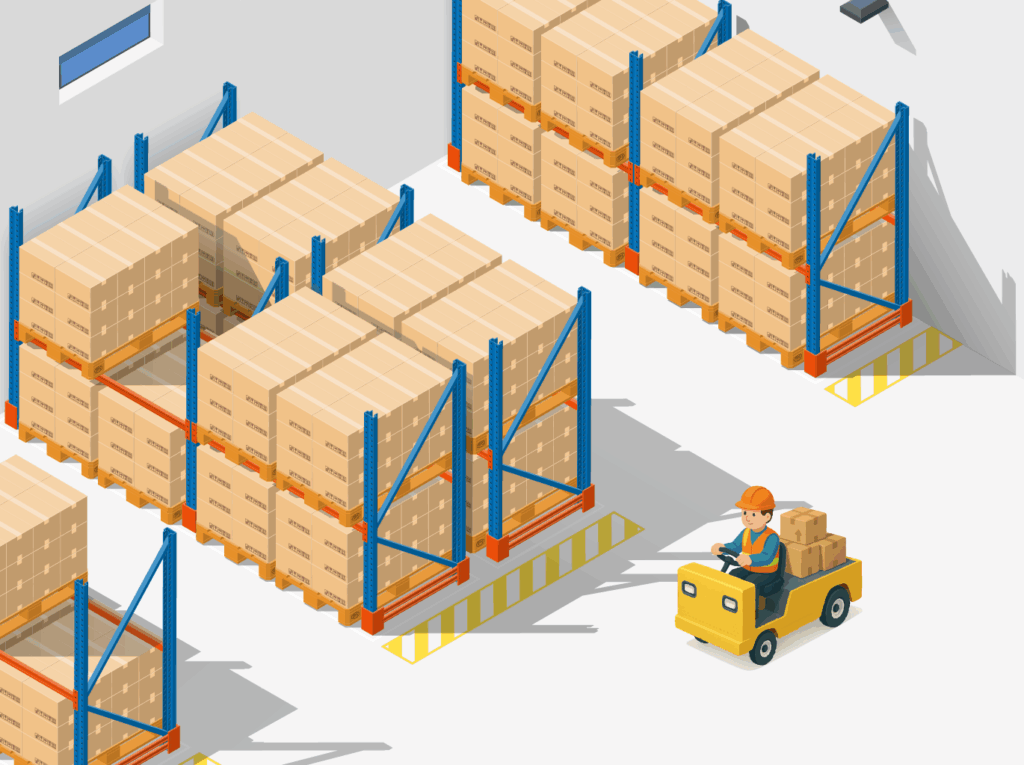

- Warehousing and Logistics: Warehouses and distribution centers use EUVs extensively for material handling and internal logistics. Electric forklifts, pallet jacks, and reach trucks lift and move pallets of goods. Electric tow tractors pull trains of carts for order fulfillment. Because they produce no exhaust, these vehicles can operate indoors without harming air quality. They are also quieter than engine-powered equipment, which improves communication on the warehouse floor.

- Facility and Grounds Maintenance: Factories, airports, campuses, and resorts rely on electric utility vehicles for maintenance and support tasks. Personnel carriers (small shuttle vehicles) ferry staff across large facilities quickly. Maintenance crews use burden carriers and utility carts to carry tools, parts, and supplies for repairs.

- Construction, Agriculture, and Industrial Sites: Robust utility terrain vehicles (UTVs) and electric off-road trucks are emerging in construction and agriculture. On construction sites, compact electric loaders and UTVs can move materials or workers around without the noise and emissions of traditional equipment – useful for indoor construction projects or city sites with noise ordinances. In agriculture, farmers are beginning to use electric UTVs and tractors for tasks like shuttling feed and supplies or even plowing small fields.

Overall, EUVs have proven their versatility. Whether it’s a warehouse forklift fleet running on lithium batteries or a groundskeeping cart quietly patrolling a park, electric utility vehicles are becoming the go-to solution.

Market Breakdown and Growth Projections

Electric Utility Vehicle Market Overview

The global electric utility vehicle market has been experiencing robust growth as industries embrace electrification. According to market research, the global EUV market (encompassing industrial utility vehicles and off-road utility vehicles) was valued at $8.59 billion in 2021 and is forecast to reach $24.98 billion by 2031.

Several factors are driving this growth. Rising fuel costs and stricter emission regulations have made electric vehicles more attractive, while technological improvements (especially in batteries) have lowered operating costs. Many businesses also have corporate sustainability or ESG goals that encourage the switch to zero-emission vehicles. The result is a steady replacement of older gas or diesel equipment with electric models in warehouses, factories, airports, and other settings.

Electric Utility Vehicle Batteries Market

Battery technology trends (lithium-ion vs. lead-acid)

Batteries are the beating heart of any electric vehicle, and advancements in battery technology are a pivotal factor in the EUV market’s growth. Traditional lead-acid batteries have powered many electric forklifts and utility carts for decades, but they come with limitations: they are heavy, have relatively low energy density, and require regular maintenance (watering, equalizing charges) plus long charge times.

In recent years, the industry has been rapidly shifting toward lithium-ion battery technology for utility vehicles. Lithium-ion batteries are much lighter, offer higher capacity and voltage, and can be opportunity-charged (charged in short bursts during breaks) without harming the battery.

Lifecycle and charging innovations

Modern li-ion packs can last longer per charge and over more total charge cycles. Some models can support fast charging, allowing vehicles to significantly recharge in a lunch break or between shifts, reducing downtime. Manufacturers are also innovating with battery swapping systems and improved charging infrastructure. For instance, there are facilities using battery swap stations for vehicles – when one battery depletes, a robot or technician swaps it with a fresh one in minutes, keeping the forklift running nearly continuously.

Autonomous Utility Vehicle Market

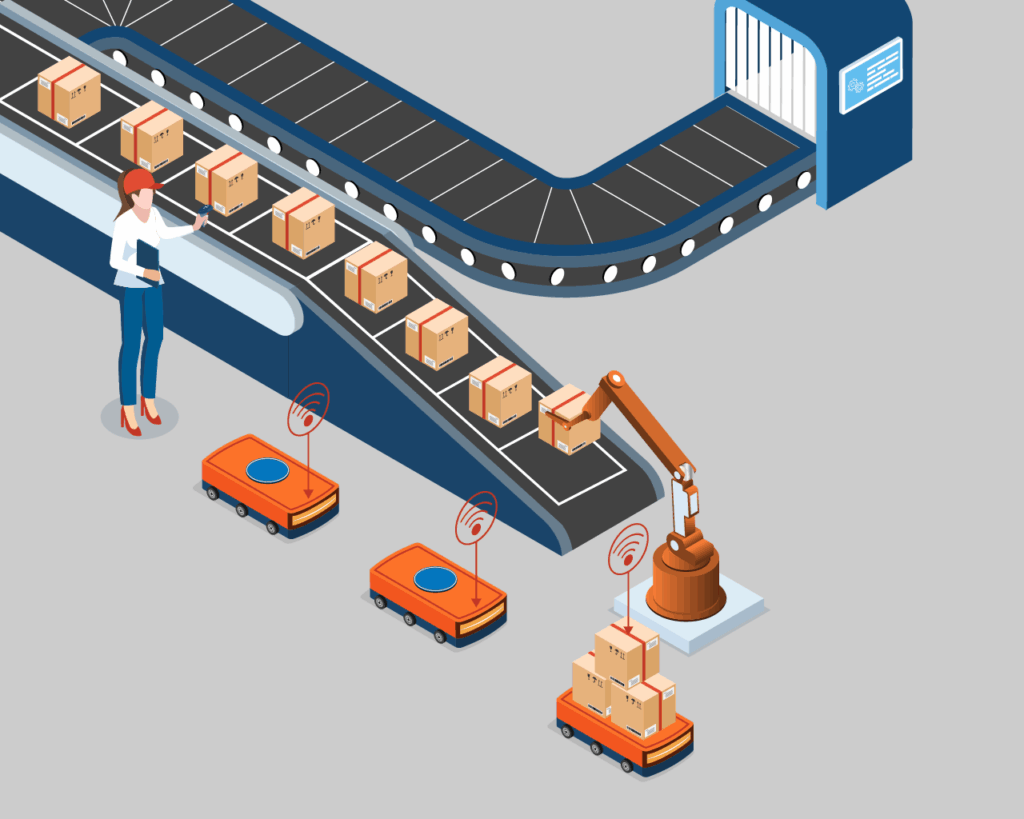

Another exciting aspect of the EUV landscape is the integration of automation and autonomous driving technologies. The concept of self-driving vehicles isn’t limited to cars on highways – it’s also making inroads in warehouses, factories, and even airports in the form of autonomous utility vehicles.

Integration of automation

In warehouses, we are seeing the rise of automated guided vehicles (AGVs) and autonomous mobile robots (AMRs) that handle material transport without direct human operation. For example, companies like Toyota and Linde now offer automated electric forklifts and tow tractors that can navigate predefined routes to move pallets or tow trains of carts. These systems use lasers, cameras, or magnetic tracks to find their way safely through facilities. The benefit is performing repetitive tasks (like shuttling parts from one end of a factory to another) continuously without breaks, freeing up human operators for more complex tasks.

The autonomous utility vehicle market is still emerging and currently represents a smaller fraction of all EUVs. Many fleet managers take a cautious approach to automation, often running pilot programs first. Integration with existing warehouse management systems and training staff to work alongside robots are important considerations. However, the growth trajectory looks strong. The same trends boosting EUVs (better batteries, lower costs, computing advances) also boost autonomy.

Compact & Light Electric Utility Vehicle Market

Not all electric utility vehicles are big or expensive – in fact, one notable trend is the surge in demand for small-scale, light-duty electric utility vehicles. These compact EUVs are filling niches in urban and industrial environments where agility and small size are key.

Surge in demand for small-scale industrial vehicles

One driver of this trend is the rise of dense urban warehouses and facilities. As space in cities is at a premium, we see more micro-fulfillment centers and multi-story warehouses with narrower aisles. Compact electric vehicles, like stand-up forklifts, stock chasers, or small pallet stackers, are in high demand for these environments. Their slim profiles and tight turning radius allow them to navigate places where larger vehicles cannot.

Use cases in urban environments

Urban delivery and service vehicles are trending smaller and greener. Many cities are exploring or already implementing zero-emission zones, where only electric vehicles are allowed for last-mile deliveries. This has led to interest in small electric utility vans and quadricycles that can legally drive on city streets but are much more compact than typical trucks.

Another area of growth is in parks, resorts, and large campus facilities. Here, small electric shuttles and trucks are replacing gas-powered utility carts. For example, parks departments are using tiny electric trucks to water plants and collect trash along city streets and in public.

The compact utility vehicle market also spans recreational and consumer areas. Golf carts were among the earliest electric utility vehicles, and they remain popular not just on golf courses but in retirement communities and campuses. Now, more advanced “personal utility vehicles” are appearing – think of a ruggedized golf cart with a cargo bed, lights, and maybe a cab enclosure.

In summary, small and compact EUVs are experiencing a surge in demand as new use cases emerge. Their benefits mirror those of larger EUVs – clean, quiet, and cost-efficient – but their smaller form factor opens up possibilities in places larger vehicles can’t go.

Electric Utility Vehicle Manufacturers

The electric industrial utility vehicle market is served by a mix of long-established equipment manufacturers and newer specialized companies. Understanding who the leading manufacturers are can give insight into the market’s development and the options available for fleet managers. Below we highlight both global leaders and innovative newcomers in the EUV space.

Several major vehicle manufacturers dominate production of electric utility vehicles, often leveraging their experience in related fields:

Toyota is the world’s largest forklift manufacturer and has been a pioneer in electric forklifts and warehouse vehicles. They offer an extensive range of electric forklifts, pallet jacks, and tow tractors. Toyota’s commitment to electrification is long-standing – they introduced their first production electric forklift decades ago and continually improve battery and control technology.

Clark is historically known as the inventor of the forklift. Today, Clark produces a full line of forklifts, many of which are electric models (from three-wheel riders to reach trucks). Clark has made significant strides in offering lithium-ion battery options in their forklifts to remain competitive.

Polaris is a leader in off-road and recreational vehicles, and they have applied that expertise to electric utility vehicles. Polaris produces electric utility terrain vehicles (UTVs) and low-speed vehicles, especially through their GEM and Ranger EV lines.

Club Car (a brand under Platinum Equity, formerly part of Ingersoll Rand) are major players in the electric cart and utility vehicle market. Club Car is synonymous with golf carts, but they also produce industrial utility vehicles and street-legal low-speed vehicles (like the Club Car Urban EV).

Founded in the late 1980s, Motrec is a Canadian manufacturer that focuses exclusively on electric industrial vehicles. They aren’t exactly a “startup” anymore, but compared to century-old forklift companies, Motrec is a newer specialized player. Motrec builds a wide range of industrial EUVs – from tow tractors and burden carriers to personnel carriers and stockchasers. Their vehicles are often found in factories, airports, and campuses worldwide.

Columbia is another specialized manufacturer that produces only electric vehicles, with a history going back several decades. Columbia makes a variety of industrial and commercial EVs, including burden carriers (like the Columbia Payloader which can carry and tow hefty loads), personnel transporters, and utility carts. Their Columbia Expediter and Utilitruck models, for example, are popular for maintenance and delivery roles in large facilities.

(Note: Conger Industries carries several of these leading brands, including Toyota, Columbia and Motrec utility vehicles.)

Industrial Use Cases: Real-World Applications

In this section, we’ll look at concrete use cases and examples of EUVs in action, focusing on warehousing and manufacturing environments. These examples illustrate the tangible benefits – from emission reductions to cost savings – that facility managers are realizing by deploying electric utility vehicles.

Electric Utility Vehicles in Warehousing

Warehouses, distribution centers, and fulfillment facilities have widely adopted EUVs and offer textbook examples of their advantages:

Indoor air quality and safety: By using electric forklifts and pallet trucks, warehouses maintain much cleaner air. Unlike propane or diesel forklifts, electrics have no exhaust fumes, which means employees aren’t exposed to combustion gases while working around the equipment. This is especially critical in tightly enclosed warehouses or refrigerated storage where ventilation is limited.

Quiet operation: Electric utility vehicles operate with minimal noise—mostly just the hum of electric motors and the beep of a reversing alarm. In a warehouse, this can improve safety (it’s easier for workers to hear each other or notice alarms) and reduce noise-related fatigue.

Material handling efficiency: Electric forklifts often have excellent low-end torque, meaning they can accelerate smoothly with heavy loads and offer fine control for precise maneuvers (like lining up fork tines with a pallet).

Continuous operation with charging strategies: Warehouses have learned to manage charging such that electric vehicles can run essentially non-stop across shifts. A common practice is opportunity charging – charging equipment during breaks, lunch, or during loading lulls. For example, an electric forklift might get plugged in for 15 minutes while the operator fills out paperwork. These top-up charges keep batteries going such that a separate battery change isn’t needed. Many large warehouses install charging stations at convenient spots (like near break rooms or dock areas) to facilitate this.

High utilization and automation: Electric vehicles are easier to integrate into automated workflows. For instance, Amazon’s fulfillment centers famously use thousands of autonomous mobile robots (AMRs) (the orange Kiva robots) to move shelving units – those are essentially small electric utility vehicles specialized for inventory transport.

Environmental impact: Replacing a fleet of internal combustion forklifts with electric in a warehouse eliminates tons of carbon emissions. An electric forklift can cut about 12 tons of CO₂ annually compared to a diesel. Warehouses that have done this transition essentially make their operations much greener.

Electric Utility Vehicles Case studies

Curious how EUVs perform in real-world settings? Explore the case studies below to see how warehousing and manufacturing operations are using electric utility vehicles (EUVs) to cut emissions, reduce costs, and boost efficiency in labor, energy use, and overall performance.

Automating Success

Kolbe Windows & Doors partnered with Conger to implement Toyota Automated Guided Vehicles (AGVs), reducing material handling labor by 20% and achieving ROI in under 12 months.

Powering Sustainability

We helped Essity transition from LPG to Toyota lithium-ion forklifts, reducing carbon emissions by 245 tons annually and cutting energy costs by 52%.

Fleet Electrification in Manufacturing Facilities

Manufacturing facilities present another fertile ground for electric utility vehicles. Factories often have both indoor and outdoor logistics needs – moving raw materials in, shuttling work-in-process goods between departments, and carrying finished products out to storage. Fleet electrification in these settings can yield big returns, and many manufacturers are now conducting ROI analysis and transitioning their vehicle fleets (forklifts, tuggers, utility trucks) from fossil fuels to electric power.

Energy and Fuel Cost Savings: One of the easiest to quantify benefits is the savings on fuel. Electric vehicles cost significantly less to “fuel” than diesel or gas vehicles. We can look at an example: A standard diesel forklift (around 3-ton capacity) might consume about 3.2 liters of diesel per hour of operation. At a diesel price of say $1.85 per liter, that’s about $5.92 in fuel per hour. A comparable electric forklift might use around 7.3 kWh per hour; at an electricity price of $0.30/kWh, that’s roughly $2.19 per hour in electricity.

Maintenance Savings: Electric vehicles generally have fewer moving parts and simpler drivetrains than combustion vehicles. There are no engines requiring oil changes, spark plug replacements, or air filter services. Brakes on electric vehicles often last longer thanks to regenerative braking taking some load.

Upfront Cost vs. Total Cost of Ownership: It’s true that electric utility vehicles can have a higher upfront purchase price, mainly due to the cost of the battery. (E.g., a new 5,000 lb propane forklift might cost $25k, whereas the electric equivalent could be $35k+ because you’re effectively buying the battery “fuel”.)

Reliability and Uptime: Modern electric vehicles are very reliable. For manufacturing, where a halted production line can cost a fortune, reliability is crucial. Electric vehicles have proven they can meet heavy-duty demands – many factories run electric forklifts 2-3 shifts a day with appropriate charging strategy.

Incentives and Carbon Credits: Manufacturers can sometimes take advantage of incentives for electrification. Besides the tax credits mentioned earlier, in some regions companies can earn carbon offset credits or participate in cap-and-trade markets by reducing emissions. This can add an extra financial kick for going electric (though it’s more variable and industry-specific). Nonetheless, these potential credits or avoided carbon taxes (like in places where carbon is taxed) can be factored into ROI positively.

The Future of the Utility Vehicle Market

Looking ahead, the electric utility vehicle landscape is poised to evolve even further. We can anticipate not only a continuation of current trends (like broader adoption and technology improvements) but also new developments in aftermarket support, industry expansion, and innovative integrations.

Utility Vehicle UTV Parts & Accessories Market

As electric utility vehicles become ubiquitous, a robust parts and accessories market is growing around them. Much like how the rise of automobiles led to flourishing aftermarket parts industries, the proliferation of EUVs is creating demand for specialized components, upgrades, and services post-sale.

One area of opportunity is battery replacements and upgrades. The batteries in electric vehicles have finite lifespans (albeit long). Fleet owners will eventually need new batteries for their vehicles, which could mean buying from the OEM, or perhaps turning to third-party battery suppliers who offer compatible units, possibly with improved performance (higher capacity) or lower cost. Already, companies are emerging that focus on retrofit lithium-ion battery packs for older lead-acid forklifts – effectively giving legacy vehicles a new lease on life with better technology. Accessories and customization are another growth segment. Because electric utility vehicles are often used for specific tasks, companies want to customize them for maximum productivity. This drives a market for attachments and modifications: for example, different types of hitches for tow tractors, container carriers, tool chest add-ons for maintenance carts, or scissor-lift attachments for utility vehicles to double as aerial work platforms.

There’s also the matter of spare parts. Motors, controllers, sensors, and electronic boards will need replacements over time. As volumes of electric utility vehicles in operation increase, the spare parts market will become lucrative. Large OEMs typically supply parts through their dealer networks (for instance, Toyota will supply genuine parts through authorized dealers like Conger). But in a mature market, often independent parts suppliers spring up, especially once patents expire or if generic equivalents can be made.

Expansion of EV Utility Vehicles Across Industries

Right now, we frequently mention warehouses, factories, and logistics as key domains for electric utility vehicles. But in the future, expect EUVs to permeate virtually every industry and sector where vehicles are used for operational support. The versatility of electric drive, coupled with pressure to reduce emissions everywhere, means many sectors that historically used gas/diesel utility vehicles will convert to electric.

Consider logistics and freight beyond warehouses: seaports and rail yards are big targets. We’re already seeing electric yard tractors at distribution centers and ports. Companies like Kalmar and Orange EV produce heavy-duty electric terminal tractors (yard trucks) that move shipping containers and trailers.

In agriculture, while we touched on electric UTVs, the trend will likely go further: electric tractors and harvesters for certain farming applications. Companies like Monarch Tractor (a startup) have released a small autonomous electric tractor aimed at vineyard and orchard work. Larger firms like John Deere have shown prototypes of electric tractors and riding mowers.

As each industry adopts electric vehicles for their specific needs, there will be cross-pollination of innovations. For instance, mining demanded very robust battery cooling systems and those improvements might trickle down to improve warehouse vehicle batteries. Conversely, advances in fast charging for warehouse fleets can be applied to construction equipment on job sites.

In essence, the expansion across industries means the electric utility vehicle market isn’t a one-trick pony – it’s going to be a fundamental part of how all sorts of work is done. We will likely stop thinking of “electric” as a special category and just assume most utility vehicles are electric by default in the future, whether it’s in a factory, farm, or theme park.

For industrial and warehouse managers, this broad acceptance across industries is reassuring. It means continued investment and innovation in the technology, and it means if you operate across multiple sites or business lines, you can adopt electric vehicles in all of them with proven success. The sharing of best practices will extend beyond warehousing – a facility manager might take inspiration from how an airport manages their electric fleet, and vice versa.

Predicted Electric Utility Vehicle Market Trends

Looking towards the horizon, a few key trends are expected to characterize the electric utility vehicle market:

Smart Integrations and Industry 4.0

Future EUVs will be deeply integrated into digital systems. Smart warehouses and factories will have equipment that communicates in real time. Electric utility vehicles will likely become mobile data hubs, feeding information to management systems. This could include location tracking, load weights, battery health, and even environmental data (some forklifts might carry sensors to monitor warehouse temperature or air quality as they roam).

Autonomy and Advanced Assistance

We’ve talked about autonomous vehicles; by the end of this decade, it’s reasonable to predict that a sizable minority of utility vehicles shipped will have some autonomous or semi-autonomous capability. Even those that remain operator-driven will likely feature advanced driver-assistance systems (ADAS) to enhance safety and productivity.

Cost Reductions and Mass Adoption:

Economies of scale are expected to further reduce costs of electric utility vehicles. Battery prices are projected to drop even more as global EV production (including passenger cars) soars.

Longer Lifespans and Secondary Markets

As technology matures, electric utility vehicles might enjoy longer service lives than their ICE counterparts. We touched on maintenance; if a vehicle frame and motors can last 15+ years and you can swap batteries, that could extend useful life. This gives rise to a secondary market for used EUVs.

Charging Infrastructure and Energy Management

The more vehicles go electric, the more attention will be paid to efficient charging infrastructure. In the future, we might see standardized fast chargers for industrial batteries, maybe even wireless charging in some applications (for example, a utility vehicle could park over a charging pad during loading).

Emergence of New Vehicle Categories

Innovation may create entirely new categories of utility vehicles. For example, the concept of robotic delivery vehicles for indoor/outdoor use could blur the lines between a mobile robot and a utility vehicle. Or multi-purpose platforms that can switch roles (one hour a tug, next hour a scissor lift, next a shuttle).

In terms of market forecasts, many sources anticipate strong growth and penetration. One projection suggests the EUV market will reach ~$45 billion by 2032 with a healthy CAGR around 9–10%, while others like Allied predicted even higher growth rates to 2031. These numbers signal that all these future trends are coming on the back of a robust market expansion.

All told, the future of electric utility vehicles is bright. We can expect smarter, more autonomous, and more affordable vehicles spreading into every nook of industry and commerce. For businesses, this means planning infrastructure and operations with an electric mindset: installing enough charging capacity, training staff on new systems, and leveraging the data and capabilities that these advanced vehicles provide.

Conclusion

In practical terms, if you manage a warehouse or facility and haven’t already begun electrifying your fleet, now is a great time to start planning. Assess your current equipment – likely there are electric replacements or upgrades available for many of them. Engage with experts or dealers (for instance, Conger Industries, which specializes in electric industrial vehicles and can provide guidance on the latest models and charging solutions) to map out a phased transition. Often, companies start with a pilot – maybe a couple of electric forklifts or an electric utility cart in one department – then expand as they see the benefits firsthand.

It’s also wise to consider the charging and power needs as part of the planning. Work with your facilities team to ensure the electrical supply can support multiple chargers, and explore smart charging systems to optimize energy use. In many cases, upgrades like this can be rolled into the project of acquiring the vehicles themselves.

In conclusion, the rise of electric industrial utility vehicles represents a significant positive shift for industrial operations. It aligns economic incentives with environmental responsibility – a true win-win. Managers who lead their organizations in adopting EUVs will not only reduce costs and improve efficiency, but also future-proof their operations in a world that is undeniably moving toward electrification and sustainability. The electric utility vehicle market is charging ahead (quite literally), and those who hop on board will drive their operations into a cleaner, more productive future.

The bottom line: Electric utility vehicles are here, they’re proven, and they are shaping the future of industrial mobility. Now is the time to take advantage of what they have to offer and keep your business moving forward with this powerful trend.